Rethinking the Hunter and Farmer Divide in Sales

By Marko Kiers on Nov 18, 2025

When organizations consider new sales hires, they often debate whether they need a hunter who focuses on acquiring new customers or a farmer who manages and grows existing relationships. The question sounds simple, but does it truly make sense to view sales roles as binary choices between the two archetypes? In reality the distinctions are far more nuanced.

Some professionals naturally enjoy the pace and energy of cold outreach, while others prefer the depth and continuity of long term client partnerships. These personality differences are real, but the idea that commercial work divides cleanly into two separate species is not accurate. Many companies still cling to this model because it feels intuitive and easy to organize. It provides clarity and focus.

But clarity is not the same as effectiveness.

Splitting roles can certainly be the right approach, but only when both the strategy and the business context genuinely warrant it.

To understand when this is the case, we will examine the deeper drivers behind every commercial outcome and explore the models for blending or separating these classic roles.

Trust as the foundation of growth

There is one element that sits behind every commercial result.

Trust.

Trust builds slowly through repeated interaction, shared experience, and consistent delivery. It requires meaningful investment. This is why winning new customers is several times more difficult and more costly than growing existing ones. Win rates of sixty to seventy percent are common with existing clients. New business win rates often sit between five and twenty percent.

Product trust can be created through trials and demos. Personal trust is much harder to earn. In higher value markets the commercial relationship itself becomes the deciding factor. New Business teams must create trust in the product and trust in the people before a deal closes. This trust is fragile because it has not yet been reinforced by real usage.

Existing clients live in a different reality. They experience your product every day. They interact with your teams. Their trust is reinforced through delivery, onboarding, and service. It compounds. And despite this compounding effect, trust remains fragile when exposed to transitions that feel unplanned or unnecessary.

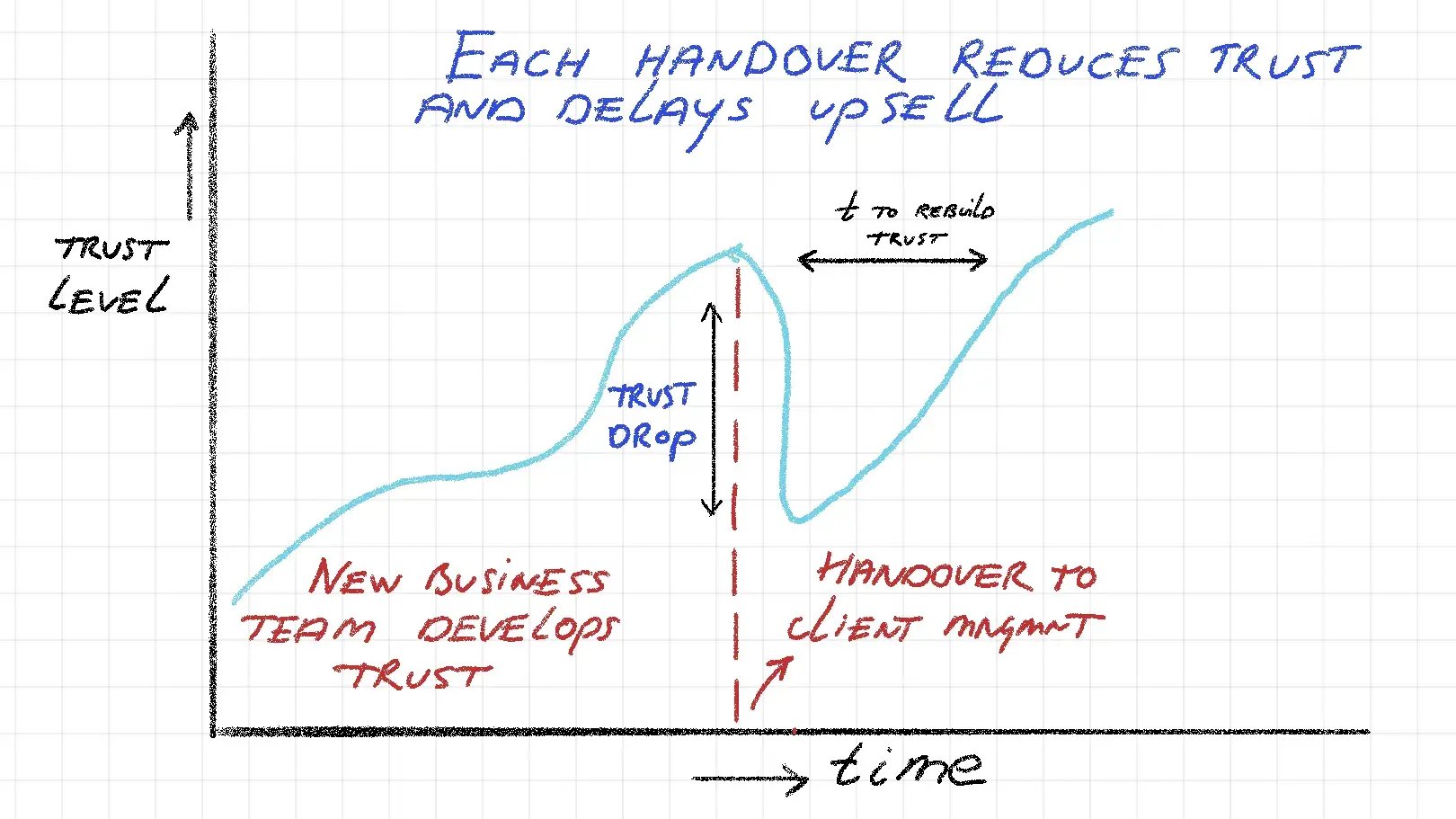

This is where a strict split between New Business (Hunters) and Client Management (Farmers) can work against you. These setups often involve a handover of new clients after onboarding or a few months of operation. Every handover creates a moment where trust can diminish. In the earliest stages of a customer relationship, handovers are especially risky because the client has not yet built enough experience to absorb friction. If challenges appear during onboarding or delivery, the strength of the relationship often determines whether the account grows or disappears.

When trust is built, it extends within a clients internal base and through external networks. This ripple effect strengthens references and boosts word of mouth. Ultimately, it turns customers into advocates, impacting not only current clients but also creating momentum for new business.

This is the engine behind Customer Experience led Growth. Satisfied customers become reference clients.

Transferring accounts can be a highly effective strategy, even though it carries the risk of diminishing trust. But unless handovers are delivered exceptionally well, supported by clear processes, integrated systems, and compensation that rewards continuity, the trust gap quickly becomes a growth gap.

How to decide between splitting or blending sales roles

A split between New Business and Client Management can be effective, but only when the surrounding commercial environment fully supports it. There are four factors that determine whether specialization is the right choice.

1. Where does growth truly come from

A split starts to make sense when a company depends heavily on new logo acquisition to reach its goals. Even then, specialization works only when enough qualified opportunities flow into the top of the funnel. With little marketing support, there is a risk of morale and performance drops and attrition of new business team members will increase.

If most growth potential sits within the existing customer base and when sales motions between an initial deal and upsell do not differ significantly, a blended model can be an option. Upsell, account penetration, reference sales, and expansion are driven by relationship continuity. In these environments, splitting ownership can reduce the speed and depth of trust.

| Sales Model | Primary Company Growth Driver | Key Rationale | Operational Requirement |

| Specialized (Hunter/Farmer) | New Logo Acquisition (Landing accounts) | Separates the distinct skill sets required for prospecting/closing new deals (Hunters) from those needed for relationship management and expansion (Farmers). Creating efficiencies are the main driver for splitting roles. |

Consistent, high volume flow of qualified leads (TOFU) to maintain the focus and productivity of the New Business teams. Tooling to support mapping target accounts for cold outreach. |

| Integrated (Full-Cycle/Blended) | Account Expansion (Upsell, Consumption, Retention) | Maintains a single point of contact (Full-Cycle AE) throughout the customer journey, which fosters relationship continuity, builds trust, and drives deeper account penetration. Enhancing trust level (and valuing the economic impact of trust) is a main driver for blending roles. |

Incentive plans that support blended sales to focus on upsell as well as landing new accounts. |

2. Which (horizontal) segments are you targeting

The dynamics of each (horizontal) segment have a substantial impact on how a commercial organization is structured. These dynamics are especially important when determining whether roles should be separated.

Enterprise accounts are characterized by political navigation, multi-stakeholder orchestration, and lengthy sales cycles (often 6 to 18 months). Credibility and trust are built over many detailed interactions. An increased efficiency (by splitting roles) should be extremely well weighed against the impact of trust levels dropping by handovers, particularly in this segment.

A split between teams focused on breaking open new Enterprise accounts and nurturing current ones, only works when the buyer journey is highly structured and limits the trust gap. It should be extremely well supported by clearly defined handover processes, excellent onboarding and customer success and service teams. Without this maturity, splitting roles fragments relationships and slows Enterprise growth rather than enabling it.

Mid Market & Small Business presents a unique blend of complexity and agility. The SMB segment normally benefits from high inbound volume, short sales cycles, and less dependence on deep personal trust. Mid-Market deals are faster than Enterprise and represent a higher volume of total prospects. A split in roles often shows up specifically in the SMB market (see the Alexander Group's research about this topic). But, specialization is only justified when there is sufficient deal (MQL) flow to keep dedicated roles productive; otherwise, blending account management and new business drives stronger results and greater customer & employee satisfaction.

3. What is the balance between Product Led and Sales Led Growth

If your product builds trust through trials, transparency, and self-service, the reliance on deep personal relationships naturally lessens, making role specialization more effective. This is often true for simpler products, where a single buyer can make the purchasing decision instead of requiring input from multiple stakeholders.

Conversely, if your offering is complex, service-intensive, or high-value, trust is rooted primarily in the people involved rather than in the product interface. In these scenarios, dividing responsibilities can create friction.

It’s essential to identify where you fall on the spectrum between Product Led Growth (PLG) and Sales Led Growth (SLG). Organizations leaning toward SLG often see better results with a single owner who can maintain trust throughout the entire customer journey.

4. How strong is your demand generation engine

This is the most overlooked factor.

Hiring hunters without supplying them with qualified opportunities slows growth. Instead, it will be a money and frustration pit. Without an excellent demand generation engine, win rates stay low, acquisition costs rise, and the organization enters a cycle of hiring and losing team members. Next to inbound demand generation, its essential to review your strength in supporting sales teams with cold outreach support tools (i.e Clay).

As agentic AI and automated demand tools increase the number of qualified leads (in all segments including Enterprise), competitors who scale their demand generation engine will lower acquisition costs dramatically. Organizations that respond simply by adding more team members will fall behind.

A strong go to market strategy models the number of qualified opportunities (MQL - Marketing Qualified Leads) needed per segment and aligns hiring, compensation, and structure accordingly. If the demand generation engine cannot sustain a specialized model, the split will not succeed.

Considering these factors, the effectiveness of specialization and blended commercial models depends on the broader organizational environment. Different organizations observe varying outcomes in areas such as trust, stability, and predictability of revenue, depending on the approach chosen. This brings us to the next question.

When blended sales roles make sense

A blended model works well when several strategic conditions come together.

- There is a high possibility of growing clients beyond the first sell (high upsell potential at existing accounts). Growth is coming mainly from harvesting upsell potential.

- There are no big differences in sales motions between the initial sell and the upsell phase. Both require a high level of Trust to succeed.

- The company relies on a Customer Experience led Growth approach, with a heavy reliance on Sales Led Sales motions influenced by a higher product complexity level.

- The volume of Marketing Qualified Leads is relatively low and customers rely heavily on word-of-mouth reference sales. (Relatively low MQL = levels are sitting below 25 percent of all leads in a mixed Enterprise and Mid Market environment).

In these situations, splitting roles rarely delivers better results. A blended approach strengthens trust, improves customer experience, and creates a more predictable commercial motion. To make it successful, several structural elements must be in place.

What is needed for a successful blended structure

1. Hire sales professionals who can challenge and guide customers

Recruit for the ability to challenge assumptions, manage change, and bring insight. Do not hire for the hunter or farmer stereotype. The best blended sellers deeply understand customer challenges and can move conversations from status quo to opportunity (whether its a prospect or existing client).

A conversational interview is not enough to search for this profile. Ask candidates to present a customer case that mirrors a real commercial situation, which represents both a current client and new business. This reveals their ability to guide stakeholders and demonstrate structured thinking in a mixed environment.

2. Build balanced account sets based on clear segmentation

Blended does not mean that every seller works every account. It means each seller manages a focused portfolio that includes a defined set of existing clients and a curated list of target accounts.

Enterprise sellers usually manage one or a few existing accounts and a small set of strategic targets. Mid Market sellers can handle more. The key is alignment with your segmentation strategy. Once account sets are defined, compensation reinforces the right behavior across acquisition and expansion.

3. Set ambitious mixed targets for new and existing business

A blended model works only when sellers carry meaningful targets for both sides of the commercial motion. If targets can be met by upsell alone, new business will be deprioritized. Balanced targets ensure that sellers do not focus on whichever path is easiest, but on the mix that drives sustainable growth.

Compensation for the client management component of mixed patches should not only focus on upsell, but also on items such as client satisfaction (NPS) scores.

4. Use whitespace analysis and target account planning as core disciplines

Whitespace analysis maps every path for expansion and highlights competitive presence and product penetration. Ideally this is supported by automated data inside the CRM, which feeds Account Based Marketing efforts.

At the same time blended sellers build Target Account Plans and sector plans. Managers play a critical role by providing structure, coaching, and cadence to support both acquisition and expansion.

5. Minimize unnecessary (yearly) account handovers

Many organizations undertake large-scale territory or account reassignments each year. However, frequent account transfers can erode trust and slow down growth. While some segmentation adjustments are inevitable, they should be kept to a minimum. Maintaining stability is a competitive edge, as trust is nurtured through ongoing continuity.

Potential pitfalls in blending roles

A problem in mixed roles can be that successful team members will be the inhibitor of their own success. Keeping clients while adding new ones creates a great upsell potential, but soon patches become to big and there will be no focus on gaining new customers. Management should be aware of this and potentially shave of existing accounts (while keeping the danger of eroding trust in mind). In essence this is a luxury problem and opens the case for adding additional team members and the possibility to create dedicated vertical (manufacturing, retail, etc) teams to create additional focus.

Hybrid approaches between blended and 100% Hunter-Farmer splits

Some organizations adopt a hybrid model, maintaining blended ownership while introducing a small layer of Sales Development or Business Development capacity. In smaller companies, SDR and BDR responsibilities are often combined into a single function. These teams respond swiftly to inbound leads and support targeted outreach across the portfolio, but they do not take ownership of accounts. Instead, they help accelerate momentum at the top of the funnel without introducing additional trust transitions later in the process.

This approach allows a single commercial owner to retain the client relationship, preserving trust, while expanding reach and speed where it matters most.

Hybrid structures can also reflect different approaches across horizontal or vertical markets. For instance, in a specific organization, SMB and Mid-Market teams may benefit from more clearly separated hunter-farmer roles, while Enterprise teams rely on a blended model to foster trust and support long-term account growth.

Ultimately, every organization is unique; these hybrid strategies should align closely with overall business strategy and the specific dynamics of each market segment.

What this means for your organization

Commercial organizational design should be shaped by strategy rather than stereotypes or legacy practices. The ideal structure depends on where the quickest revenue growth is achievable, the customer segments you target, your position within the SLG or PLG motion spectrum, and the true effectiveness of your demand generation efforts.

Most importantly, trust erosion during client handovers should be a central decision point when choosing between splitting New Business and Client Management or adopting blended roles. When these transitions disrupt established relationships, they can undermine growth significantly and harm your level of Commercial Excellence.

You May Also Like

These Related Stories

Why Customer Experience Should Be Your Competitive Advantage

Scaling Faster, Together: Turning Partnerships into Growth Multipliers